Creating a Roadmap for Small and Mid-sized Company Growth

Running a small or mid-sized company is challenging, and navigating financial matters can be one of the most challenging aspects of the job. Business owners must balance expenses, revenue, taxes, and investments to achieve their long-term growth goals. Strategic financial planning is critical to creating a roadmap for success. In this blog post, we will discuss the importance of financial planning for small and mid-sized companies. We will also explain how Coltivar’s strategic and financial guidance can help companies navigate these challenges and achieve their growth objectives.

1. Setting Financial Goals: Goal setting is the first step in creating a strategic financial plan. Financial goals provide a roadmap for business owners to create a clear vision for their company's future. Goals may include revenue targets, profit margins, or reducing expenses. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals helps small and mid-sized business owners stay focused on achieving long-term growth and stay on track to achieve their goals.

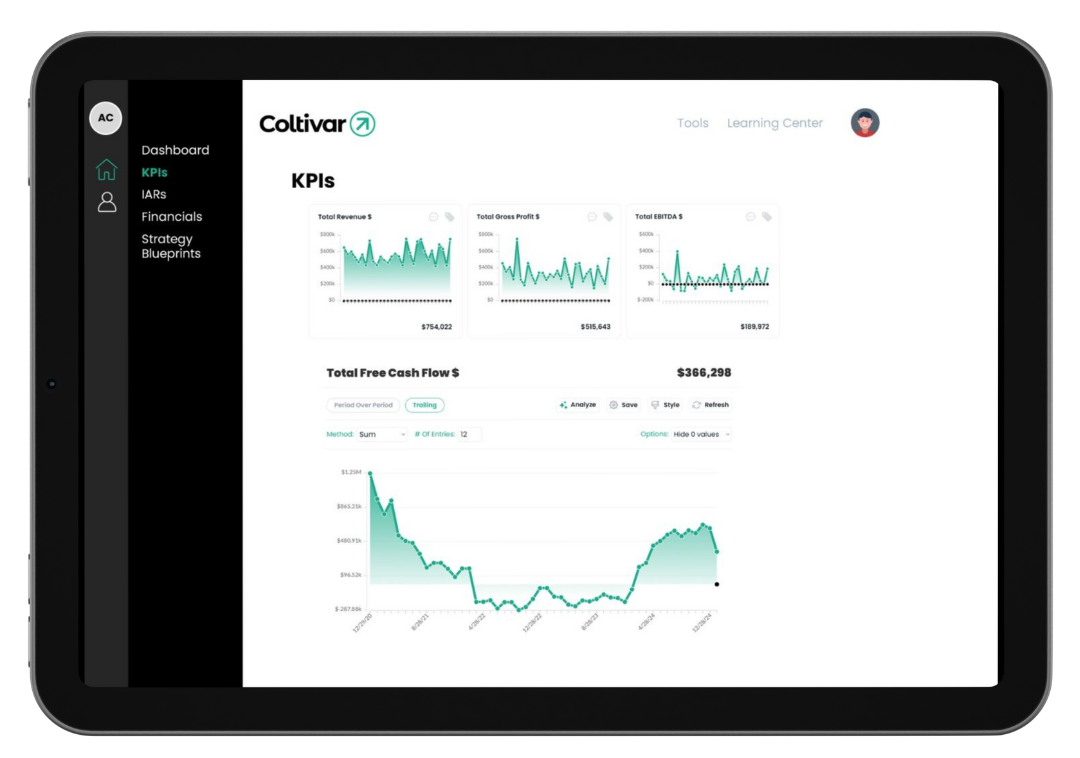

2. Cash Management: Cash management is critical for small and mid-sized companies, especially during uncertain times. Managing cash flow helps business owners know where their money is going and how to allocate it to maximize their growth. Effective management of accounts receivable, accounts payable, and inventory management helps business owners track their expenses and make informed decisions about their growth strategy.

3. Risk Management: Small and mid-sized business owners face several risks, including market risk, liquidity risk, legal and regulatory risk. Business owners must be aware of these risks and have a plan in place to mitigate them. Having a risk management plan in place can help business owners avoid unexpected financial challenges, safeguard their finances, and minimize their exposure to losses.

4. Tax Planning: Tax planning is a crucial aspect of financial planning for small and mid-sized companies. Business owners must keep abreast of changes in tax laws and regulations to minimize their tax liability. Tax planning helps business owners save on taxes and maximize their net income. It also helps business owners make informed decisions about their investments, business activities, and compliance.

5. Professional Financial Guidance: Seeking professional financial guidance from experts like Coltivar can help small and mid-sized business owners develop a financial strategy that works for their business. Financial consultants can provide tailored solutions for financial management, cash flow forecasting, risk assessment, tax planning, and more. Coltivar can help businesses navigate complex issues, identify opportunities, and take advantage of new trends in their industry.

In conclusion, financial planning is critical for small and mid-sized companies to navigate the unpredictable business landscape and achieve their long-term business goals. Effective financial planning includes setting financial goals, cash management, risk management, tax planning, and professional financial guidance. Coltivar can help business owners develop a roadmap for success that suits their unique financial needs. If you're interested in learning more about Coltivar's financial and strategic guidance, reach out to our team to discuss how we can help you achieve your business objectives.