How to Get Clarity on My Business Numbers

In this post, we’ll show you how to gain clarity on your business numbers—even if they’ve felt confusing, incomplete, or inconsistent in the past. If you’re leading a $3M–$20M company, your business has likely outgrown gut instincts and spreadsheet guessing. You need a clear, real-time view of your financial performance to make faster, smarter, and more confident decisions.

But here’s the challenge: most founders didn’t start their companies to read financial statements. You might be seeing profit, but struggling with cash. Or you’re unsure whether your pricing model is actually making you money. Clarity is possible—and it starts by organizing the right information in the right way.

Key Takeaways

-

Clarity starts with knowing which numbers matter most

-

Your P&L doesn’t tell the full story—cash flow, margins, and trends matter too

-

Systems and rhythms—not spreadsheets—create consistent insight

The Real Cost of Not Knowing Your Numbers

When you don’t have financial clarity, decisions get delayed, opportunities get missed, and stress multiplies. You might find yourself constantly reacting to shortfalls, overspending on low-return activities, or struggling to explain performance to your team or investors. Even worse, you might feel like things are working—when they’re actually unraveling under the surface.

Financial fog creates risk. And in growth-stage businesses, that risk gets expensive fast.

Start with the Three Numbers That Matter Most

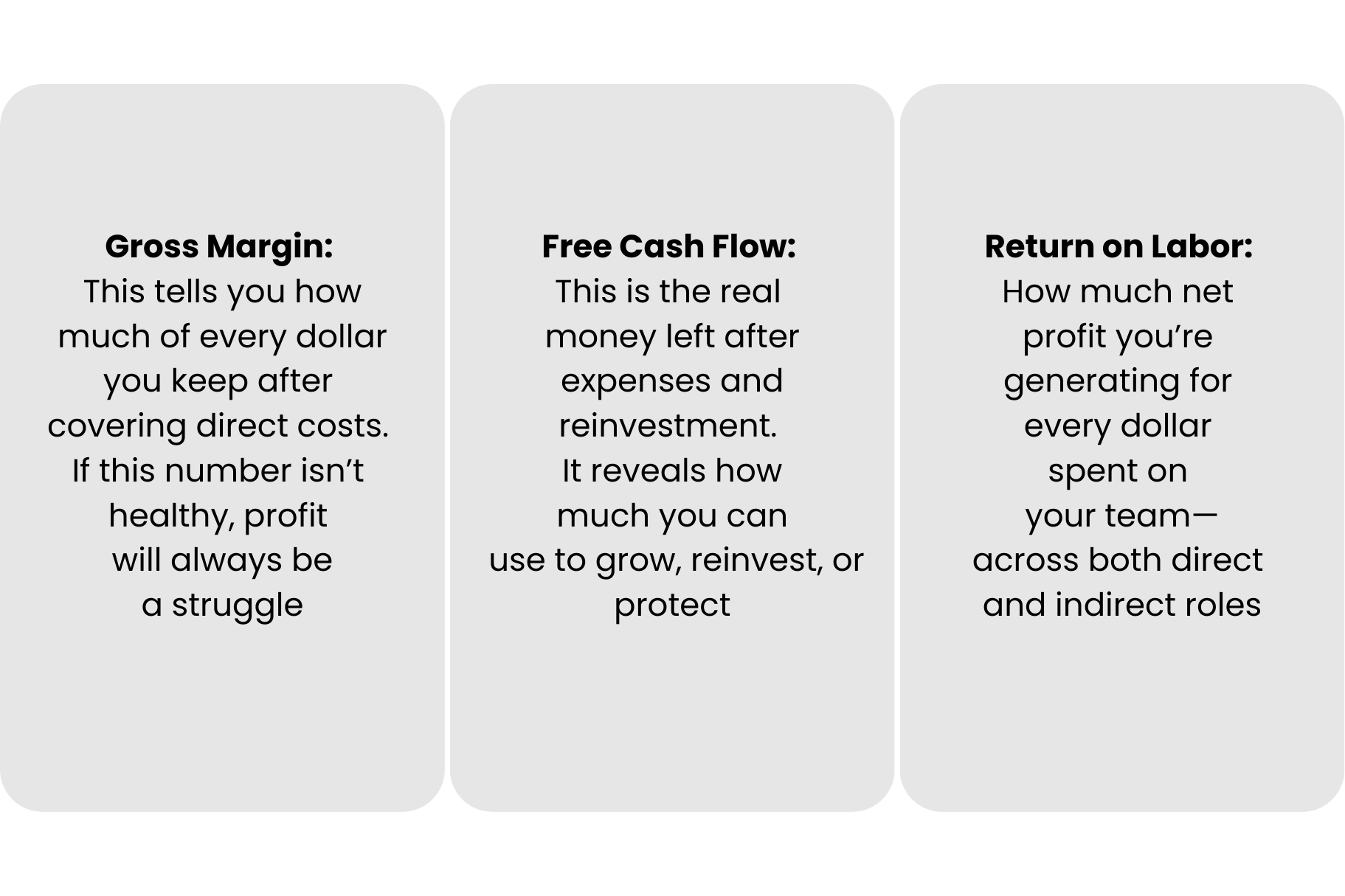

You don’t need to track dozens of metrics to gain clarity. You just need to start with the few that give you the clearest picture of your business health. At Coltivar, we recommend beginning with three foundational numbers:

These three numbers give you insight into profitability, cash control, and team efficiency. From there, you can add KPIs based on your unique business model and growth priorities.

Build a Simple Reporting Rhythm

Clarity doesn’t come from a better spreadsheet—it comes from a better system. Start by committing to a regular financial review process. This means updating and reviewing your numbers weekly, monthly, and quarterly—not just at year-end or when things go wrong.

Here’s a structure we recommend:

-

Weekly: Review cash balances, payables, and receivables

-

Monthly: Close the books, review your income statement, and compare actuals to forecast

-

Quarterly: Assess trends in margin, cash flow, and key KPIs—and reset goals if needed

Assign ownership. Whether it’s your controller, bookkeeper, or CFO, someone must be responsible for ensuring the numbers are updated, accurate, and accessible.

Build a Dashboard That Translates Numbers into Decisions

Financial clarity isn’t about more data—it’s about better visibility. That’s why we recommend building a dashboard that puts your key numbers in one place. Think of it as your strategic control panel. It should show what’s working, what’s sliding, and what actions to take.

Don’t overcomplicate it. Start with the basics:

-

Revenue vs. forecast

-

Gross margin by product or service

-

Monthly net income

-

Operating cash flow

-

Cash-on-hand runway

Visuals matter. Use charts, color coding, and trend lines to make it easy to spot issues or improvements. And keep it updated so your leadership team can use it to drive weekly and monthly decisions.

Final Word: Clarity Is a Competitive Advantage

Knowing your numbers gives you more than just peace of mind—it gives you power. You can price more confidently, forecast more accurately, hire more responsibly, and invest with more precision. You stop reacting—and start leading.

At Coltivar, we help business leaders create simple, strategic financial systems that deliver real clarity—so they can scale with confidence and make every move count.

Ready to get clear on your numbers and take control of your financial performance?

Book a Strategy Review and let’s build your clarity dashboard together.